Detailed Directions for Finishing Your Online Tax Return in Australia Without Errors

Detailed Directions for Finishing Your Online Tax Return in Australia Without Errors

Blog Article

Navigate Your Online Tax Obligation Return in Australia: Necessary Resources and Tips

Navigating the online income tax return procedure in Australia requires a clear understanding of your commitments and the sources offered to improve the experience. Essential papers, such as your Tax Data Number and earnings statements, must be diligently prepared. Additionally, picking an appropriate online platform can dramatically influence the effectiveness of your filing process. As you consider these elements, it is crucial to likewise understand typical mistakes that lots of experience. Recognizing these subtleties can eventually conserve you time and minimize anxiety-- leading to a much more beneficial result. What approaches can best aid in this undertaking?

Comprehending Tax Commitments

Recognizing tax commitments is important for people and services operating in Australia. The Australian taxes system is controlled by different legislations and laws that require taxpayers to be familiar with their obligations. Individuals must report their income properly, that includes salaries, rental income, and investment revenues, and pay tax obligations appropriately. Moreover, residents have to recognize the difference in between non-taxable and taxable revenue to make certain compliance and maximize tax outcomes.

For companies, tax responsibilities include numerous elements, consisting of the Product and Solutions Tax (GST), business tax obligation, and pay-roll tax obligation. It is essential for organizations to register for an Australian Business Number (ABN) and, if applicable, GST enrollment. These duties demand precise record-keeping and timely entries of tax returns.

In addition, taxpayers need to be acquainted with readily available deductions and offsets that can ease their tax concern. Seeking suggestions from tax obligation experts can give valuable understandings right into maximizing tax positions while guaranteeing conformity with the law. Generally, a detailed understanding of tax obligation commitments is vital for efficient financial planning and to prevent penalties related to non-compliance in Australia.

Vital Papers to Prepare

Additionally, compile any relevant bank declarations that reflect rate of interest revenue, as well as dividend statements if you hold shares. If you have various other sources of income, such as rental residential properties or freelance work, guarantee you have documents of these incomes and any type of linked costs.

Don't forget to consist of reductions for which you might be eligible. This could involve receipts for occupational costs, education and learning costs, or philanthropic contributions. Consider any kind of exclusive health insurance coverage declarations, as these can affect your tax obligation commitments. By collecting these essential files ahead of time, you will certainly enhance your online tax obligation return process, lessen errors, and optimize possible reimbursements.

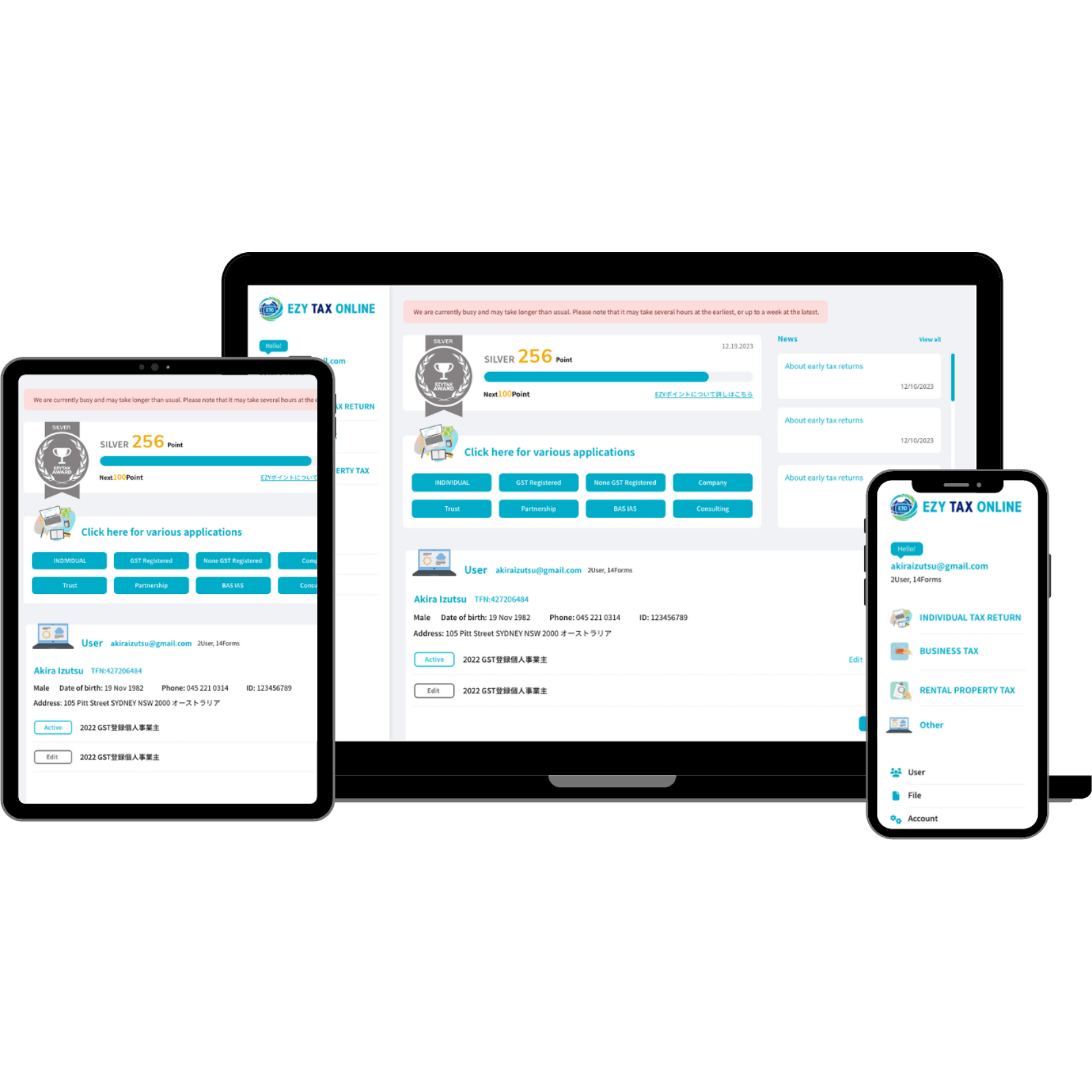

Picking the Right Online Platform

As you prepare to file your on-line tax return in Australia, picking the ideal system is vital to make sure precision and simplicity of usage. A straightforward, intuitive layout can considerably boost your experience, making it much easier to navigate intricate tax obligation types.

Following, evaluate the system's compatibility with your economic situation. Some solutions cater especially to people with simple income tax return, while others give thorough assistance for a lot more intricate scenarios, such as self-employment or investment earnings. Additionally, look for platforms that use real-time error monitoring and assistance, assisting to minimize mistakes and ensuring conformity with Australian tax legislations.

Another crucial aspect to think about is the degree of customer support available. Reputable systems ought to provide access to assistance using email, phone, or chat, particularly throughout height declaring durations. Additionally, study customer reviews and rankings to gauge the general fulfillment and integrity of the system.

Tips for a Smooth Declaring Process

Submitting your on the internet tax return can be a straightforward process if you comply with a couple of essential pointers to Web Site ensure performance and accuracy. This includes your revenue statements, invoices for reductions, and any kind of various other pertinent documentation.

Next, benefit from the pre-filling attribute used by many on the internet platforms. This can save time and minimize the opportunity of blunders by automatically occupying your return with info from previous years and data offered by your company and financial institutions.

In addition, ascertain all entries for precision. online tax return in Australia. Mistakes can cause delayed refunds or issues with the Australian Taxes Office (ATO) Make certain that your personal information, income figures, and deductions are appropriate

Declaring early not only lowers stress yet also allows for much better preparation if you owe taxes. By following these pointers, you can browse the online tax obligation return procedure smoothly and with confidence.

Resources for Support and Assistance

Browsing the complexities of on the internet tax returns can sometimes be complicated, however a range of resources for assistance and support are easily offered to assist taxpayers. The Australian Taxes Office (ATO) is the primary resource of information, providing thorough overviews on its website, including FAQs, instructional videos, and live conversation options for real-time support.

In Addition, the ATO's phone support line is readily available for those that favor direct communication. online tax return in Australia. Tax obligation experts, such as authorized tax obligation representatives, can also offer tailored advice and guarantee conformity with existing tax obligation laws

Conclusion

Finally, properly navigating the on-line tax obligation return process in Australia requires a thorough understanding of tax obligations, careful preparation of important documents, and mindful choice of a proper online system. Following useful pointers can enhance the Visit This Link declaring experience, while readily available resources use valuable support. By coming close to the procedure with diligence and attention to information, taxpayers can make sure compliance and make best use of possible benefits, eventually contributing to an extra efficient and effective tax return result.

As you prepare to file your on-line tax obligation return in Australia, picking the best platform is crucial to guarantee accuracy and simplicity of usage.In final thought, effectively browsing the on-line tax obligation return process in Australia calls for a detailed understanding of tax obligation responsibilities, careful preparation of vital papers, and mindful option of an ideal online system.

Report this page